PERFORMANCE OF PRINCIPAL MARKETS

In September, markets experienced contrasting trends, influenced by several major events. Indeed, the Chinese market rebounded sharply after the government unveiled an economic stimulus plan to support growth, while in Japan, the appointment of Shigeru Ishiba as Prime Minister raised serious concerns among investors, leading to a drop in the Nikkei. In parallel, in the United States, the Federal Reserve (FED) initiated its interest rate reduction cycle with a 50 basis point cut in its key rates, justified by the continued decline in inflation and the sluggish development of the labor market. The European Central Bank (ECB) and the Swiss National Bank (SNB), for their part, lowered their key rates by 25 basis points.

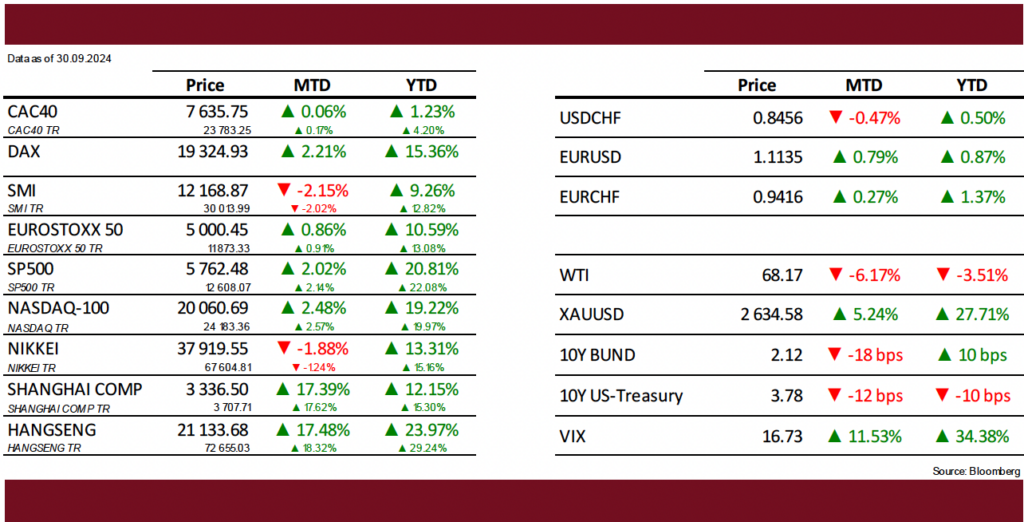

Over the past month, the S&P 500 posted a gain of +2.0%, the EuroStoxx50 +0.9%, and the CAC40 +0.1%, while the SMI closed down by -2.2% and the Nikkei by -1.9%. The Chinese market soared, with the Hang Seng index up +17.5%. On the commodities side, gold continued its upward trend, rising by +5.2%, silver by +8.0%, and copper by +6.0%, while the price of a barrel of oil (WTI) fell below the $70 mark.

ECONOMIC AND FINANCIAL ENVIRONMENT

Amid a historically dynamic economic situation, China has implemented an ambitious plan to stimulate its economy and financial markets. During a recent Politburo meeting, leaders announced an increase in budgetary spending aimed at supporting growth and reaffirmed their commitment to stabilizing the real estate market. Following this, the People's Bank of China enacted a larger-than-expected interest rate cut, lowered banks' reserve requirements, and introduced measures to reduce mortgage costs, sending a positive signal to investors. These measures triggered a powerful stock market rally, with shares seeing their best days since September 2008: the CSI300 surged +21.9%, and the Hang Seng rose +17.5%, driven by strong rebounds from large-cap stocks such as JD.com (+56% for the month), Alibaba (+35%), and Tencent (+16%).

In the United States, inflation indicators for August continued to ease. The Consumer Price Index (CPI) showed a modest increase of +0.2% for the month and +2.5% year-over-year, compared to +2.9% the previous month. Core inflation, which excludes the volatile prices of food and energy, rose by +0.3% in August and +3.2% year-over-year, slightly higher than the expected +0.2%. The PCE index, which tracks the prices of consumed goods, increased by +2.2% year-over-year, down from +2.5% the previous month, edging closer to the Federal Reserve’s target. In Europe, price increases also moderated, with the eurozone inflation rate standing at +2.2% this month, down from +2.6% in July.

Employment data for August in the U.S. was disappointing, with +142’000 non-farm payroll (NFP) jobs created versus +161’000 expected, while figures for the previous two months were revised downward by a total of -61’000 jobs. This revision is part of a much larger one announced in August by the Labor Department, which downgraded job creation between March 2023 and March 2024 by -818’000 jobs — nearly 30% of the jobs initially reported during that period, marking the largest revision since 2009! For August, the majority of the new jobs created were in construction (+34’000), healthcare (+31’000), and social assistance (+13’000). Despite these relatively weak job gains, the unemployment rate only slightly decreased to 4.2%, from 4.3% in July. However, the real unemployment rate, which excludes discouraged workers who have stopped looking for work and adjusts for part-time jobs, stands at 7.9%, its highest level since October 2021

Although the U.S. economic outlook appears to be moving in the right direction according to the figures released by the administration, and investors remain optimistic following the recent action by the Federal Reserve (FED), certain historical indicators still call for caution. These include the rise in the real unemployment rate in recent months, the steepening of the yield curve that had been inverted since mid-2022, and the continued decline in the Leading Economic Indicator (LEI) for the sixth consecutive month.

In this environment, the "soft landing" scenario, which has been the consensus for months, remains the preferred outcome. The prospect of interest rate cuts seems sufficient for investors, who are convinced that monetary policy changes alone can prevent a deterioration in the economic situation and allow financial markets to continue their strong momentum, despite current valuations—especially those of certain large-cap stocks—being historically high. In the short term, perhaps, but we remain skeptical over the medium term, as these valuations already factor in significant monetary easing (-200 basis points by the end of 2025), while earnings growth struggles to justify the continued market rally. In any case, the FED will need to continue navigating very skillfully to avoid a scenario of economic slowdown or even a recession.

OUR THOUGHTS AND ACTIONS

In the current environment, still characterized by significant fiscal support and an accommodative US Federal Reserve, we maintain a neutral asset allocation, both in terms of exposure to risky assets and geographical distribution. At the same time, with the cycle of interest rate hikes nearing its end and geopolitical tensions remaining high, we are increasing our exposure to medium- and long-term quality bonds at the expense of short-term bonds, while continuing to hold our investments in gold.

1. PERFORMANCE OF PRINCIPAL MARKETS

In August, financial markets showed increased volatility, correcting significantly at the start of the month before recovering lost ground and even, for some, reaching new highs at the end of the month. In the United States, while new concerns are emerging on the employment front, inflation figures are rather encouraging, as they continue to move towards the central banks' target of 2%. In his recent speech at the central bankers' summit in Jackson Hole, Federal Reserve Chairman J. Powell confirmed that the time had come for the US to begin cutting key interest rates. The question now is no longer when the FED will cut rates, but by how much it will do so at the upcoming FOMC meeting on September 18th-19th.

Kindly refer to the link at the bottom of the page to view the table.

Over the past month, the S&P500 rose by +2.3%, the EuroStoxx50 by +1.8%, the SMI by +1.0% and the CAC40 by +1.3%, while the Nikkei closes the month down -1.2%, after falling by almost -12% in beginning of August. The trend in weak economic indicators and geopolitical tensions continued to underpin the rise in the price of gold, which rose by +2.3% over the month. At the same time, the yield on the 2-year Treasury note contracted by 34bps, while that on the 10-year fell by 13bps, allowing the yield curve to flatten to close to 3.90%.

2. ECONOMIC AND FINANCIAL ENVIRONMENT

In August, we witnessed the unwinding of part of the yen carry trade, phenomenon that sparked a surge in market volatility at the beginning of the month. For reference, this investment strategy that involves taking advantage of low interest rates to borrow in yen and reinvest in higher-yielding currencies, has generated interesting returns for investors over the past few decades. However, as this practice reached its peak, fueled by a significant interest rate differential due to divergent monetary policies between the Bank of Japan (BoJ), which kept its key interest rate at zero, and the FED, whose rates remain around 5.5%, the BoJ’s recent decision to raise its rates caught many investors by surprise and disrupted the strategy. As a result of this announcement, these investors were forced to sell off yen-denominated assets to repay part or all of the loans they had taken out, adding further pressure to financial markets already affected by the low liquidity typical of the summer period.

In the United States, inflation indicators for July are in line with expectations and continue to move in the right direction. The consumer price index (CPI) rose by +0.2% over the month and +2.9% year-on-year, compared with +3.0% the previous month. Core inflation, which excludes volatile food and energy prices, also rose by +0.2% over the month and +3.2% year-on-year, which was viewed positively by the financial markets. J. Powell also stated that although the task is not yet complete, considerable progress has been made towards the 2% inflation target.

Modest employment data for July have revived fears about the strength of the US economy. The data revealed the creation of 114’000 non-farm payrolls (NFP), below the 175’000 expected, concentrated in the healthcare (+55’000), construction (+25’000), government (+17’000) and transport (+14’000) sectors. At the same time, although it has gone almost unnoticed, the US Bureau of Labor Statistics has sharply revised downwards job creation for the period between March 2023 and March 2024, i.e. -818’000 jobs, or around -30%! This revision highlights a fundamental problem for central banks, which are forced to take crucial decisions based on unreliable economic indicators. Finally, the unemployment rate increased to +4.3%, up from +4.1% the previous month, confirming the accelerating deterioration of the job market. The average unemployment rate over the past three months is now more than 0.5% higher than the lowest quarterly average of the previous 12 months. The current level of this indicator, known as the “Sahm Rule”, has almost always preceded a recession. We will hence be watching its development very closely over the coming months.

As is the case every year, August was the scene of the central bankers' summit in Jackson Hole, at which J. Powell announced, to no real surprise, that the time had come to cut US key rates. The consensus is now for a cut of around 100bps (-1.0%) between now and the end of the year, with a cut of between 25bps and 50bps expected on 18th September. This announcement comes at a time when the job market is showing signs of weakness and the Leading Economic Index, an aggregate that weights 10 economic indicators in order of importance, is down -0.6% to 100.4, below the level seen at the low point of the Covid crisis in 2020 (100.5). At the same time, consumer confidence rose to 103.3, its highest level in six months, although this masked the fact that the confidence of low-income households was falling. Low-income households are increasingly facing financial difficulties, as evidenced by the recent results of Dollar General (DG), a low-cost US retailer, which significantly revised its forecasts for the current year due to declining demand. The current economic situation therefore remains difficult to read, but there is no denying that the signs of weakness are piling up.

Despite this, the "soft landing" scenario, which has been the consensus view for months, remains the preferred one. It seems that the prospect of an interest rate cut is blinding investors, who are convinced that the change in monetary policy alone will prevent a deterioration in the economic situation and allow the financial markets to continue their formidable path. In the short term perhaps, but we remain skeptical about the medium term, given that current valuations already anticipate strong monetary easing, and that earnings growth is struggling to justify market growth. Whatever happens, the Fed will have to manoeuvre very skillfully to avoid a scenario of stagflation or even recession.

3. OUR THOUGHTS AND ACTIONS

In the current environment, we are maintaining a neutral asset allocation, both in terms of exposure to risky assets and geographical spread. At the same time, with the cycle of interest-rate rises coming to an end and geopolitical tensions still rife, we are increasing our exposure to quality medium- and long-term bonds, to the detriment of the short term, while maintaining our investments in gold and oil.

4. THEME OF THE MONTH: ETFs

In recent years, passive investment via ETFs (Exchange-Traded Funds) has grown spectacularly. These funds, which faithfully replicate various indices, appeal to investors not only because of their performance, but also because of their low cost, transparency, and liquidity. This month, we look at what's really going on, as their popularity raises crucial questions about the true diversification they offer, their influence on the structure and quality of indices, and the risks associated with this type of investment vehicle.

There is no doubt that ETFs can offer several advantages that make them attractive to investors. First, numerous studies show that their performance has often outperformed that of active funds in the past, particularly when ETFs aim to replicate the performance of the main global indices, and more specifically those of large-cap US stocks. In addition, ETFs offer greater transparency, flexibility and liquidity. Unlike some active funds, they can be bought and sold in real time during market opening hours, enabling more dynamic portfolio management. For smaller investors, ETFs also represent an ideal solution for accessing diversification at lower cost, without the minimum capital requirements often found in active funds. These features make ETFs a simple and effective tool for building a diversified portfolio, even with limited resources. Finally, ETF management fees are generally much lower than for active funds, helping to maximize net returns for investors over the long term.

However, it is crucial not to invest blindly in this type of investment vehicle, as not all ETFs are created equal, and the mentioned advantages do not apply uniformly to all ETFs. These funds come in various categories, from ETFs that track traditional indices to thematic ETFs, leveraged ETFs, and inverse ETFs (short ETFs), each with different characteristics and risk levels. Thematic ETFs, in particular, require heightened vigilance. Although they allow investment in baskets of securities centered around a specific theme, often secular megatrends, they can offer illusory diversification. Despite comprising numerous underlying assets, these assets are often highly correlated, which makes diversification less effective while increasing volatility and, consequently, risk for the investor. As a result, while some themes may be appealing due to their potential for attractive long-term returns, this concentration can make these products unsuitable for certain investor profiles, especially those seeking genuine diversification to reduce their exposure.

It is also important to understand that leveraged and inverse ETFs can be illiquid and can potentially lead to significant losses, particularly during periods of high volatility. It is therefore essential to carefully assess the composition and structure (some do not apply physical replication) and objectives of each ETF before investing in it, taking into account your own risk profile and investment objectives.

Finally, increasing research is examining the impact of the growing dominance of passive investments on the quality of financial markets. The rising volume of index ETFs has a notable effect on market elasticity, amplifying movements both upward and downward. This phenomenon also tends to exacerbate market reversals by exposing investors to liquidity shocks. When markets are rising, investment flows into ETFs are automatically reinvested into the underlying assets (in the case of physical replication), particularly large-cap stocks that have a greater weight in indices. Consequently, these companies disproportionately benefit from this dynamic. However, during a market correction, the opposite effect occurs, leading to a more pronounced drop in prices.

According to the studies, this same phenomenon linked to investment flows also seems to have an impact on the quality of financial markets, because increased demand for these index funds artificially inflates the prices of the underlying companies, independently of their fundamental quality, thus creating a valuation bias. Investors hence buy poor-quality companies or sell good-quality securities every time a deal is struck.

In conclusion, although ETFs offer undeniable advantages in terms of cost and long-term performance, it is crucial for investors to understand the often-underestimated issues and risks associated with these products. A balanced diversification between passive and active funds within a portfolio seems to us to be an appropriate approach, allowing investors to benefit from the strengths of each strategy while mitigating potential weaknesses. ETFs can play an important role in diversification, but it is essential to choose the right indices to track. For example, ETFs that invest in exotic markets like Vietnam, or in small and medium-sized enterprises, have limited appeal in our view, as well-managed active funds are better equipped to capitalize on market inefficiencies. On the other hand, investing via an ETF in US large caps can be a smart move, especially as it allows to be more tactical during market phases. We therefore believe that we should not, as many do, oppose the two approaches, but rather combine them in order to benefit from the best of both worlds! To achieve this, careful selection and regular reassessment of choices are necessary to maximize returns and protect portfolios from the risks inherent in passive investing.

1. PERFORMANCE OF PRINCIPAL MARKETS

The world's markets ended the first half of 2024 in mixed order. While US indices continued to rise despite some signs of economic slowdown, the situation in Europe proved more delicate, notably due to political uncertainty in France.

Kindly refer to the link at the bottom of the page to view the table.

The S&P500 reached a new all-time high this month, posting +3.47% for the month (YTD +14.48%), while the EuroStoxx50 fell -1.80% (YTD +8.24%), the SMI -0.06% (YTD +7.69%), the CAC40 -6.42% (YTD -0.85%) and the Japanese market +2.85% (YTD +18.28%). In addition, the Swiss franc (CHF) depreciated during the first half of 2024 by -6.75% against the US dollar (USD) and -3.86% against the euro (EUR).

2. ECONOMIC AND FINANCIAL ENVIRONMENT

The highlight of June was a political jolt in Europe, with elections to the European Parliament by almost 360 million citizens revealing a surge in right-wing parties, particularly in Germany and France. Stung, and in response to the defeat of his centrist party, President Emmanuel Macron surprised by immediately dissolving the National Assembly in an attempt to regain a new majority. Recent polls, however, suggest that this attempt may prove unsuccessful, as voting intentions seem to indicate that the Rassemblement National (RN) would come out on top, followed by the Nouveau Front Populaire, which brings together the left-wing parties France Insoumise, the Socialist Party, the Ecologists and the Communist Party, with the consequence of a likely lack of a majority that could lead to political deadlock. These uncertainties did not spare the performance of the French index, with the CAC40 losing -6.42% over the month, nor French treasury bonds (OATs), whose yields moved significantly away from German government bonds (Bunds), nearly 80 basis points (+0.8%), confirming investors' concerns.

In the United States, inflation indicators for May came in below expectations, giving investors cause for optimism. The consumer price index (CPI) remained stable for the first time since July 2022, at +3.3% for the year. Core inflation, which excludes the more volatile food and energy prices, meanwhile rose by +0.2% over the month and +3.4% year-on-year, the smallest increase since August 2021. While these figures are encouraging, certain weaknesses are beginning to emerge in terms of activity: the University of Michigan's consumer confidence index, an economic indicator measuring the degree of optimism among consumers regarding their finances and the state of the economy, fell to 65.6 in June, after reaching 69.1 in May and 77.2 in April. So, despite the lull observed in recent months on the inflation front, price levels still seem to be having an impact on the American consumer's appetite. On average, prices in the US have risen by +20% since February 2020, while wages have not risen as much.

Employment data for May show a further notable acceleration, with the creation of +272,000 non-agricultural jobs (NFP), surpassing the +165,000 recorded in April and the +190,000 expected. The majority of these new jobs were in the healthcare (+68,000), hospitality (+42,000) and administration (+43,000) sectors, which are heavily dependent on the US government's growing budget spending. The unemployment rate reached +4.0%, up from +3.8% in March and +3.9% in April, against a backdrop of a -0.2 percentage point drop in participation to 62.5%.

At its June meeting, the Federal Reserve (FED) unsurprisingly decided to keep its key rates unchanged. Jerome Powell was optimistic about the economy, while acknowledging that progress towards the +2% inflation target was too modest. The Fed's stance remains cautious, with only one rate cut expected by the end of the current year (down from three in March), preferring to wait for more convincing data before lowering its guard. In Switzerland, the Swiss National Bank (SNB) lowered its key rate by 25 basis points (bps), or -0.25%, to 1.25% for the second time, having already done so in March. This decision is in line with lower inflation forecasts but is probably aimed at preventing the CHF from strengthening in the face of political uncertainties in Europe. Finally, the European Central Bank (ECB) also cut its main key rate by 25bp to 4.25% in an environment characterized by stable inflation for several months, close to central bankers' targets, and an economy showing signs of weakness. This is the first time that the ECB has initiated a monetary easing cycle before the FED. It should also be noted that inflation in Canada and Australia has rebounded, contrary to expectations, underlining the importance of a degree of caution on the part of central bankers to avoid a scenario where inflation starts to rise again, as was the case in the 1970s when developed economies thought they had put an end to it.

The resilience of the US economy is underpinned by the disproportionate budgetary efforts of the administration led by Joe Biden, and the acceleration of federal indebtedness led by the current Treasury Secretary, Janet Yellen, ahead of the November presidential election. In this particular environment, it's hardly surprising that inflation is struggling to continue its downward trend. But perhaps this is simply intentional, since inflation is a means that requires little effort to limit growth or reduce the country's debt ratio!

3. OUR THOUGHTS AND ACTIONS

In the current environment, we are continuing with a neutral asset allocation, both in terms of exposure to risky assets and geographical spread. At the same time, with the interest-rate hike cycle coming to an end and geopolitical tensions still rife, we are maintaining our exposure to short- and medium-term investment-grade bonds, as well as to gold and oil.

4. THEME OF THE MONTH: THE US/CHINA TRADE WAR

The Sino-American trade war, started in 2018 by Donald Trump and continued since by Joe Biden's administration, represents a large-scale economic conflict that is disrupting the global economy. The United States and China, the two biggest economic powers, have thus entered a vicious circle by imposing reciprocal tariffs on thousands of products. This has led not only to major changes in supply and production chains, but also to inflationary pressures on the price of certain raw materials and consumer goods. This tug-of-war seems to have initiated a reconfiguration of the world's power blocs, creating uncertainty and opportunities for companies and investors alike.

In 2016, during the election campaign, Donald Trump seized on the subject of the trade deficit with China and China's growing economic ambitions, accusing the latter of unfair trade practices, such as export subsidies, intellectual property theft and forced technology transfer. His election was followed by the imposition of tariffs on numerous Chinese products, and other protectionist measures designed to defend American interests and protect against a country that aspires to become the world's greatest economic power and assert itself on the geopolitical stage, threatening the current supremacy of the United States.

More specifically, the major actions taken by the United States include imposing tariffs on hundreds of billions of dollars’ worth of products imported from China from 2018/2019, banning and adding Chinese companies to a blacklist restricting their commercial business in the United States, and, most recently, imposing tariffs of up to 100% on the import of Chinese electric vehicles. Although the US administration maintains that these measures are beneficial for the country, the economic data seems to prove otherwise. Moody's, for example, considers that such actions are inflationary and could negatively impact gross domestic product (GDP) by 0.6%, with a significant impact on the middle class.

There's no reason to believe that things will change in the near future, regardless of who the next American president might be (J. Biden or D. Trump), or even that current protectionism towards China will continue to strengthen. Paradoxically, even if these initiatives seem to have an adverse effect on the global economy, the progress of the energy transition or the preservation of the purchasing power of American citizens, it is interesting to note that they significantly benefit certain countries competing with China. Indeed, the tariffs applied to the latter now make the prices charged by certain countries more attractive, enabling them to gain a prime position in the reshuffling of production and supply chains. So-called "spectator nations" such as Vietnam, Mexico and South Korea are benefiting greatly from this fundamental change in the rules of world trade, especially as these countries have been able to adapt to improve their competitiveness, underlining the great growth potential of these often emerging countries in the years ahead.

To sum up, in investment terms, the US trade war is creating interesting medium- and long-term opportunities, which we are already taking advantage of through some of our investment vehicles, notably in Vietnam.

1. PERFORMANCE OF PRINCIPAL MARKETS

In April, an economy with downwardly revised growth forecasts, coupled with more persistent inflation than anticipated, possibly suggests a scenario of stagflation. Consequently, financial markets experienced a decline throughout the month. Moreover, the persistence of inflation has prompted the Federal Reserve (Fed) to adopt a cautious stance, reducing the likelihood of a rate cut in 2024 and pushing the US 10-year yield to 4.7%, closer to the levels reached at the end of 2023.

Kindly refer to the link at the bottom of the page to view the table.

Over the month, the S&P500 fell by -4.2%, the EuroStoxx50 by -3.2%, the SMI by -4.0%, the CAC40 by -2.7% and the Japanese market by -4.9%. Gold continued to rise, gaining +2.5% over the month in response to persistent geopolitical uncertainty and continuing strong demand from central banks. In terms of currencies, the US dollar continued to appreciate, gaining +1.9% against the Swiss franc and +1.1% against the euro, as expectations of rate cuts in the months ahead receded.

2. ECONOMIC AND FINANCIAL ENVIRONMENT

In March, the US Consumer Price Index (CPI) increased by +0.4% monthly and by +3.5% year-on-year, compared with +3.2% in February. In addition, core inflation rose marginally for the third consecutive month, by +0.4% over the month and +3.7% over the year, pointing to potentially higher inflation in the longer term. Following this publication, Jerome Powell (Chairman of the FED) and some of his colleagues had no choice but to announce that they were waiting for a more favorable trend in prices before considering a rate cut, aiming to avoid repeating past mistakes. It should be noted that inflation above the central bank(s) target of 2% is not necessarily a problem as long as nominal growth turns out to be higher (i.e. real growth being positive). The real risk lies in a scenario of stagflation (high inflation and low economic growth), an environment that is dangerous for economic and financial stability.

The employment data for March seem to indicate an acceleration, with job creation excluding the agricultural sector (NFP) reaching +303’000, compared with +270’000 in February. The unemployment rate fell to 3.8%, while the employment participation rate rose to 62.7%. Once again, these statistics paint a picture of a flourishing labor market, although the pace of job creation is largely explained by a significant increase in part-time jobs at the expense of full-time positions. Finally, US gross domestic product (GDP) for the first quarter of 2024 shows growth of +1.6%, below expectations of +2.4%.

Despite the less favorable economic data, in particular lower-than-expected growth, the strength of the job market and persistent inflation have drastically reduced the likelihood of an interest rate cut by the Fed: whereas at the start of the year the consensus was for a total rate cut of 150 to 175 basis points (bps) in 2024, it now expects just 25 bps.

To date, the consensus scenario remains that of a "soft landing", or even a "no landing". A scenario supported by the excessive budgetary efforts deployed by the administration led by J. Biden and the acceleration in federal debt ($1,000bn per quarter) supported by the current Treasury Secretary J. Yellen ahead of the presidential election in November. In this particular environment, it is hardly surprising that inflation is struggling to continue its fall. Perhaps this is simply deliberate, since inflation is a means that requires little effort to limit growth or reduce the country's debt ratio.

3. OUR THOUGHTS AND ACTIONS

In the current environment, we maintain a neutral asset allocation, both in terms of exposure to risk assets and geographic distribution. At the same time, with the interest-rate hike cycle coming to an end and geopolitical tensions still very much alive, we are maintaining our exposure to short- and medium-term bonds of quality, as well as to gold and oil.

4. THEME OF THE MONTH: THE US ELECTIONS

In 2024, the calendar of government elections is particularly dense, involving the citizens of more than 64 countries, including India, Taiwan, the members of the European Union, and the United States. On 5 November 2024, Americans will be called upon to choose their next President for a four-year term. Although the official candidates will be chosen during the summer, the most likely candidates include the current President, Joe Biden, who will stand for re-election on behalf of the Democrats, and Donald Trump on behalf of the Republicans. This month we discuss the issues raised by the candidates, including: 1. Inflation and economic growth 2. The evolution of the budget deficit and the debt/GDP ratio. 3. The US-China trade war. 4. The outlook for taxes, and the potential impact of proposed policies on the real economy and financial markets.

First of all, let's take a step back to understand the structure of the US political system. Although it is multi-party, it is mainly dominated by two parties. On the one hand, we find the Democrats, who are generally associated with progressive values such as the promotion of civil rights, government intervention in social and economic issues, and environmental protection. On the other hand, Republicans are characterized by their support for conservative policies, traditional values, a pro-free market approach, and a focus on individual responsibility rather than government intervention. The presidential election is conducted by an indirect voting system, in which citizens choose the 538 members of the Electoral College (electors), who are then responsible for voting for the President and Vice-President. Once elected, the implementation of legislation depends mainly on the cooperation between the President and Congress, a bicameral system comprising the House of Representatives and the Senate. If the majority in both houses is not of the same party as the President, he is severely limited in his power to implement his party's vision. The election of these two chambers is therefore just as important as that of the President.

The 2024 election campaign appears to be a rematch of the 2020 campaign, even though the macroeconomic and political context is very different. To avoid speculating on future scenarios, let's focus instead on the actions taken by J. Biden during his term of office, and the candidates' vision for the next term.

First, let's look back at J. Biden's tenure. Inflation has emerged as a major challenge, and although inflationary pressures have eased from the 2022 peak, the real purchasing power of US consumers has eroded. In addition, the national debt has risen sharply, exceeding $34 trillion in March 2024, amplifying debt servicing costs to unsustainable levels. Nevertheless, two factors are positive: the unemployment rate has maintained a favorable trajectory, and economic growth has been more robust than expected, which has enabled the financial markets to post good performances, thanks incidentally to the enthusiasm for certain large companies.

D. Trump and J. Biden both share the goal of stimulating growth in the US economy, but their approaches differ significantly. Over the past four years, J. Biden has focused primarily on increasing government spending to support social programs such as student loan relief, reductions in bank fees (known as "junk fees") and massive initiatives to support renewable energy and infrastructure. This has had the effect of stimulating consumption but, as collateral damage, also inflation. On the other hand, D. Trump is seeking to continue the tax-cutting policy introduced by the “Tax Cuts and Jobs Act” during his first term in office, with the emphasis on tax cuts for the rich and businesses, also with the aim of stimulating economic growth, but in a different way to J. Biden's approach.

Despite these differences, the two candidates have several points in common. Firstly, they are aligned on trade policy towards China, with J. Biden having continued with the same determination the work undertaken by his rival D. Trump between 2016 and 2020. Furthermore, as far as monetary, and fiscal policy is concerned, whatever the outcome of the presidential election, in 2025, the room for maneuver seems limited and few differences are expected. Finally, under both Trump and Biden, the budget deficit has grown considerably and is forecast to continue to do so.

As far as the financial markets are concerned, historical data spanning more than 75 years shows that election periods have little effect on market performance over the medium to long term. What matters most is the state of the economy and inflation. However, a few points are worth highlighting: this year, changes in key rates by the Federal Reserve (FED), which cannot change its monetary policy in the two months preceding the elections, are likely to have a major impact on the markets. In addition, the data shows that certain sectors, such as defense, financials and small and mid-caps, seem to perform better under a Republican presidency, while healthcare and renewables seem to benefit from a Democratic presidency. In investment terms, however, our long-term convictions do not really change regardless of the outcome of the 2024 US elections.

Let’s talk

"*" indicates required fields